Are you curious about the world of Forex trading? If you’ve ever wondered why people trade Forex or how to get started, you’ve come to the right place. In this blog post, we’ll cover the basics of Forex trading, the best times to trade, and some essential trading terminology. Let’s dive in!

Why Trade Forex?

Forex, short for foreign exchange, is the global marketplace where currencies are traded. It’s a fascinating world that attracts both multinational corporations and individual traders. Companies need to exchange currencies to pay wages and expenses in different countries, while traders look to profit from fluctuations in exchange rates—much like how stock traders speculate on price changes.

So, what makes Forex trading so appealing? For starters, it’s the largest and most liquid financial market in the world, with an average daily trading volume exceeding $5 trillion. That’s right—trillions! This massive size means you can trade at any time, with plenty of buyers and sellers in the market.

Another huge advantage is the 24-hour trading window. The Forex market operates from Monday morning in Australia until Friday afternoon in the US. Whether you’re an early bird or a night owl, there’s always an opportunity to trade.

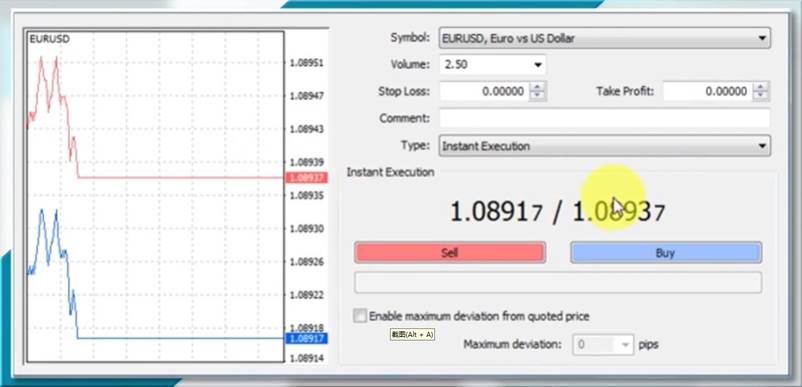

And let’s not forget about the low transaction costs. Unlike other markets, Forex trading typically has no commission fees, no exchange fees, and no brokerage fees. Brokers usually earn from the spread—the difference between the bid and ask prices. This means you can trade with minimal overhead.

One of the most exciting features of Forex trading is leverage. With leverage, you can control much larger contract values than your initial deposit. For example, with a leverage of up to 500 times your deposit, you could have an exposure of $12,000 with just $25. It’s like having a superpower in your trading arsenal!

But what if you’re new and want to practice? No problem! Most online Forex brokers offer free demo accounts. You can build your skills, practice trading, and even access real-time news and charting services—all without risking a single cent.

When to Trade Forex

While the Forex market is open 24/7, it doesn’t mean you should be trading non-stop. In fact, knowing the best times to trade can make a big difference. The Forex market can be divided into three main trading sessions: Asian, European, and US.

The Asian session runs from 12 AM to 8 AM. During this time, exchange rates tend to range a lot, with short-term fluctuations that can lead to breakouts later in the day. This session is great for trading pairs like the US Dollar to Japanese Yen (USD/JPY) and the Euro to Japanese Yen (EUR/JPY).

At 7 AM, the European session begins. London is a major player here, accounting for about 30% of all Forex transactions. This session sees a lot of movement in most currency pairs. However, things tend to quiet down around noon when traders take a break.

The US session starts overlapping with the European session around 1 PM. This overlap creates the most liquid market conditions, as traders from both regions are active. Around 5 PM, you might see rates start to race as London traders close their positions to avoid overnight risks.

After 5 PM, the market usually quiets down again until the Asian session resumes. Understanding these sessions can help you plan your trades more effectively.

Trading Terminology: Speaking the Forex Language

Forex traders often use their own jargon, which can be confusing for beginners. But don’t worry! Here’s a quick guide to some common Forex slang:

Going Long: This means placing a trade that will profit if the exchange rate rises. For example, buying the Euro against the US Dollar (EUR/USD).

Going Short: This is the opposite of going long. You place a trade that will profit if the exchange rate falls. For example, selling the British Pound against the US Dollar (GBP/USD).

Being Flat: This means you don’t have any open positions in the market. You’re essentially on the sidelines, waiting for the right opportunity

Aussie: Australian Dollar (AUD)

Kiwi: New Zealand Dollar (NZD)

Loonie: Canadian Dollar (CAD)

Greenback: US Dollar (USD)

Swissy: Swiss Franc (CHF)

Cable: British Pound to US Dollar (GBP/USD)

Fiber: Euro to US Dollar (EUR/USD)

Yuppy: Euro to Japanese Yen (EUR/JPY)

Guppy: British Pound to Japanese Yen (GBP/JPY)

Channel: Euro to British Pound (EUR/GBP)

Conclusion

Forex trading can be a rewarding journey if you understand its basics, know when to trade, and speak the language. With its massive size, 24-hour trading window, low costs, and leverage, Forex offers incredible opportunities for both beginners and experienced traders. So, whether you’re looking to make some extra income or simply want to explore a new financial frontier, Forex trading is definitely worth a try.

Follow GVD Markets, leading financial services provider, to get more financial advice!