Technical analysis in forex trading deciphers market behavior by studying historical price patterns, rooted in the premise that all available information—news, sentiment, economic data—is already priced into assets. By identifying recurring chart formations (e.g., triangles, double tops), traders exploit collective human psychology, where fear and greed drive predictable cycles of buying and selling . While these patterns often become self-fulfilling prophecies due to widespread adoption, analysts caution that subjectivity and external shocks (e.g., geopolitical events, sudden sentiment shifts) can disrupt even the most apparent trends. This article explores how price action reflects market psychology and the risks of overreliance on technical signals in volatile forex markets.

The Foundation of Technical Analysis

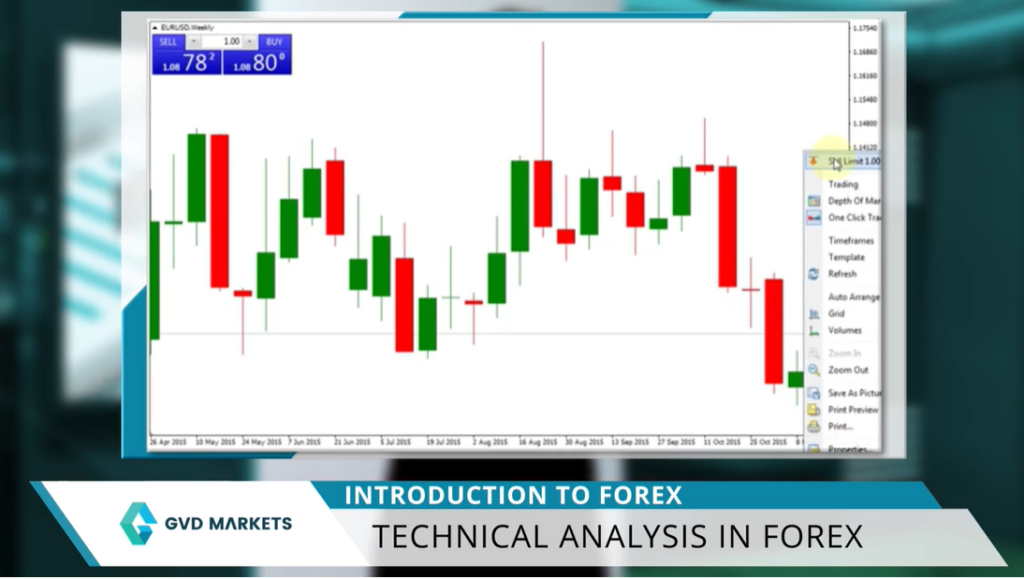

Technical analysis is built on the idea that historical price movements can help predict future trends. The core belief? All available market information—news, sentiment, economic data—is already reflected in an asset’s price. This means traders can focus solely on price action to make decisions.

Patterns and Human Psychology

Analysts study charts to identify recurring patterns like triangles or double tops. Why? Because human psychology tends to repeat itself. For example, if a price level triggered selling pressure three times in the past, traders assume it will happen again. This creates a self-fulfilling cycle: the more traders act on these patterns, the more likely they are to play out as expected.

The Role of Emotions

At its core, technical analysis in forex is a study of fear and greed. Charts are visual representations of collective human behavior. When prices rise, greed drives buyers; when they fall, fear amplifies selling. These emotions lead traders to repeat past actions—both successful and flawed.

A Word of Caution

Remember, technical analysis is subjective. Just because you see a “bullish flag” doesn’t mean others interpret it the same way. Market conditions, news events, or shifting sentiment can override even the clearest patterns.

Trade the World with GVD Markets

For traders entering the dynamic global markets of 2025, GVD Markets provides a robust platform equipped with essential tools for trading forex, stocks, and indices, alongside resources to master online trading and economic fundamentals . Our Beginner to Pro Educational Academy delivers over 100 video courses, live webinars, daily market analyses, and proprietary tools—empowering you to decode market drivers like currency fluctuations and geopolitical shifts . Whether navigating volatility or leveraging technical strategies (e.g., chart patterns, risk management), we simplify complexity with tailored support. Start your journey today and harness global opportunities with confidence.