If you’re new to Forex trading, you might be wondering how to make significant profits when trading small amounts of money. For example, if you were to trade just one euro at a time, you’d likely never see any substantial gains. This is where the concept of lots and leverage comes into play in the Forex market.

Understanding Lots in Forex

In Forex trading, currencies are traded in specific quantities known as lots. Here’s a quick breakdown:

1,000 units of a currency form a microlot.

10,000 units form a mini lot.

100,000 units form a standard lot.

At this point, you might be thinking, “I don’t have that kind of money to trade. Does that mean I shouldn’t be trading?” Not at all! This is where leverage becomes your best friend.

What is Leverage?

Forex brokers often offer leverage up to 500:1. This means that to open a position worth one standard lot (100,000 units), you only need to have a fraction of that amount in your account. For example, with 500:1 leverage, you might only need around 300 in your account to open a position worth 100,000.

Let’s break this down with an example:

Exchange Rate: EUR/USD = 1.3

Margin Set at 0.2%

You Buy 1 Standard Lot: This means you’re buying €100,000, which is worth $130,000.

Margin Required: With a 0.2% margin, your broker sets aside $260 from your account as a down payment.

Borrowing the Rest: The remaining amount is borrowed from your broker to open the position.

What is a Pip?

Now that you understand leverage, let’s talk about pips. A pip is the smallest unit of measurement in Forex trading, representing the change in the exchange rate of a currency pair. For most currency pairs, a pip is equal to 0.0001. However, for yen-based pairs, a pip is quoted with only two decimal places.

Some brokers even offer fractional pips (also known as pipettes), which provide extra precision and are displayed as a fifth decimal place.

How to Calculate Pip Value

To calculate the value of a pip, you can use the following formula:

Pip Value = (Value Change in Quote Currency) / (Exchange Rate) × (Amount of Units Traded)

Let’s look at an example:

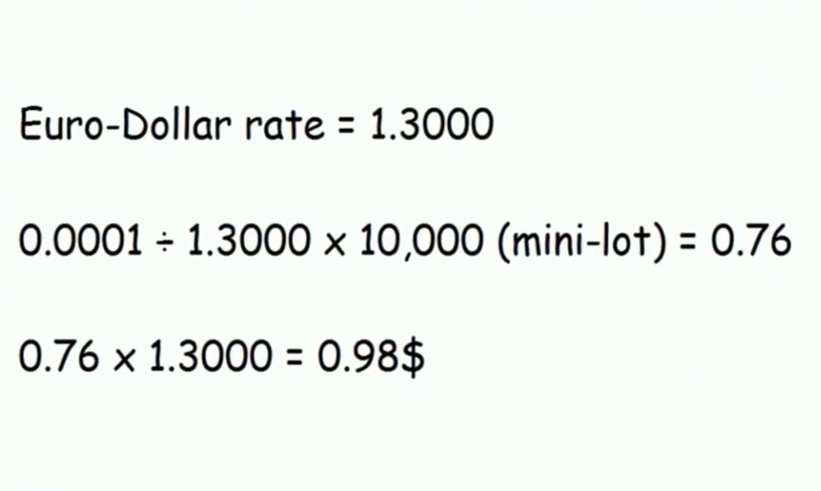

Exchange Rate: EUR/USD = 1.3000

Value Change in Quote Currency: 0.0001

Units Traded: 10,000 (mini lot)

Using the formula:

Pip Value = 0.0001 / 1.3000 × 10,000 = 0.76

To convert this to your account currency, simply multiply by your currency’s exchange rate. For example, if you’re in the US, you’d multiply 0.76 by 1.3000, resulting in $0.98.

How to Place a Trade in Forex

In forex trading, you’re always exchanging one currency for another. The goal is to buy a currency that will gain value against the one you’re selling. Every forex transaction involves two currencies:

Base Currency: The first currency listed in the pair.

Quote Currency: The second currency listed in the pair.

The exchange rate tells you how much of the quote currency you need to buy one unit of the base currency. For example, if the EUR/USD exchange rate is 1.36, you would need to pay $1.36 to buy 1 euro.

Bid and Ask Prices

When trading forex, you’ll encounter two prices:

Bid Price: The price at which your broker agrees to buy the base currency in exchange for the quote currency.

Ask Price: The price at which your broker agrees to sell the base currency in exchange for the quote currency.

The difference between these two prices is called the spread. For example, if the bid price for EUR/USD is 1.3598 and the ask price is 1.3600, the spread is 0.0002.

Final Thoughts

Trading with leverage can amplify your profits, but it also increases your risk. Understanding concepts like lots, pips, and bid/ask prices is crucial for successful Forex trading. Always remember to trade responsibly and manage your risk effectively.

Follow GVD Markets, leading financial services provider, to get more financial advice.